Student Loan Debt and Education Funding

Comparing the Biden and Trump administration policy records on higher education debt relief and funding

Photo by Logan Isbell on Unsplash.

With ever-increasing college tuition rates and former US President Donald Trump’s federal cuts to education funding, it seems almost hopeless for lower-income and middle-class families to afford college.

College costs have increased eight times faster than real wages, making it impossible for many American young people to access higher education without taking on massive, high-interest loans. In America, over forty-three million student borrowers owe $1.6 trillion in student loan debt.

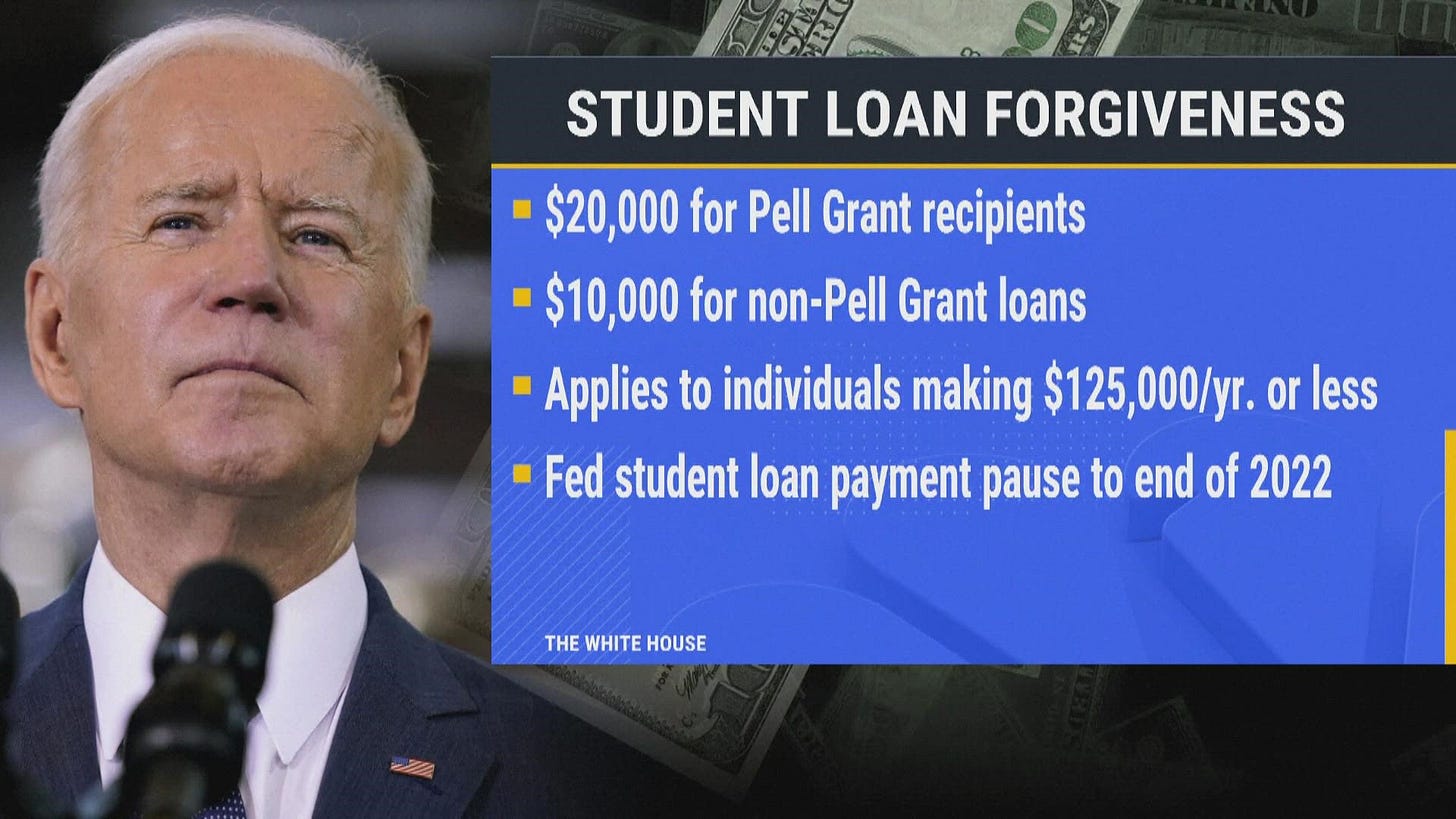

The financial outlook for young people from African American, Hispanic, and Native-American families and communities who would like to attend college is even worse. In 2022, President Joe Biden attempted to fulfill a campaign promise to bring relief to millions of Americans with student loan debt by erasing $10,000 in federal debt for people with incomes below $125,000 a year or households that earn less than $250,000. With the SAVE Plan, the Biden administration also committed to canceling an additional $20,000 for those who received federal Pell Grants to attend college.

**********

Republican (GOP) Attorney Generals (AGs) in seven “red states” opposed President Biden’s student debt relief policies, filing a federal legal challenge that eventually ended up on the docket of the US Supreme Court.

The Nebraska and Missouri AGs led five other “red state” Attorney Generals in filing the first legal challenge in September 2022. In 2023, the Supreme Court ruled that the Biden administration overstepped its authority to cancel or reduce student loan debt, ending the SAVE Plan and forcing borrowers and debtors to resume loan payments.

President Joe Biden initiated another attempt to cancel student loans in April 2024, calling the Supreme Court’s decision a “mistake.” Biden’s Education Department crafted a new plan using different executive branch sanctions while targeting borrowers for whom student debt is a significant economic challenge. Kansas AG Kris Kobach is leading eleven “red states” with a new federal legal challenge to Biden’s second attempt to provide debt relief to American borrowers.

**********

The Trump Administration Record on Higher Education

Former US Department of Education Secretary Betsy DeVos. Photo image courtesy of Gage Skidmore via Flickr.

What were the Trump administration’s policies on federal education and student debt?

Unfortunately, Donald Trump and his former Secretary of Education, Betsy DeVos, were extremely hostile to the Obama-era executive orders, regulations, and Congressional legislation designed to protect student borrowers who wish to attend college. On March 16, 2017, President Trump submitted his $1.1 trillion “America First” fiscal year 2018 budget proposal to Congress. The budget proposal included eliminating funding for the following federal education programs:

$2.4 billion for the Supporting Effective Instruction State Grants program.

$1.2 billion for the 21st Century Community Learning Centers program.

$732 million for the Federal Supplemental Educational Opportunity Grant Program.

Twenty other programs, including the Striving Readers, Teacher Quality Partnership, Impact Aid Support Payments for Federal Property, and International Education programs.

Did Betsy DeVos and Donald Trump attempt to replace the cuts to federal education funding with their own programs? The answer is no.

**********

Secretary Devos’ Department of Education announced in June 2017 that it would begin reviewing other Obama administration regulations to assist student-loan debtors.

Former President Obama’s gainful employment rule suspended federal funding for colleges and universities accused of consistently leaving graduating students with high debt, low incomes, and little to no career prospects. Obama’s borrower defense rule instituted support and protections for students seeking loan forgiveness in the event of college or university fraud.

In February 2018, Secretary DeVos also delayed the implementation of an Obama-era rule known as the “significant disproportionality” rule. The regulation prevented colleges from pushing minority students into special education programs.

To his credit, Donald Trump did increase funding to Historically Black Colleges and Universities (HBCUs) nationwide. However, that policy proposal was motivated by Mr. Trump’s desire to improve his percentage of the African American vote in 2020.

Ideally, the HBCU system helps to provide affordable education to Black people and expand the middle class.

**********

The American education system has been disparate in terms of resources and opportunities accrued to ethnic minorities for so long that it is not surprising that outcomes in academic achievement among racial categories have never been equal.

At the elementary and high school education funding levels, an estimated $23 billion funding gap currently exists between majority-White and majority-non-White school districts receiving federal support. Many poor and minority students do not experience success in our public education system as it is presently constructed. That lack of success extrapolates to the limited options ethnic minority students might have for higher education, work, and career options after high school - assuming they graduate.

In addition, most US states need federal help in funding and success outcomes regarding allowing young people of all ethnic and cultural backgrounds to access higher education at the most basic level. For instance, since 2009, Arizona has posted the nation’s most significant college tuition increases.

The 2009 hikes in college costs in “The Grand Canyon State” are more than twice the national average.

**********

Arizona also has had some of the steepest cuts in state support for higher education since 2008.

In Kentucky, sixteen percent of student loan holders are in default, three percent higher than the national average. Because of these factors, some liberal and progressive left-wing politicians are touting plans for free college as the solution to rising college debt.

Is college or university the best path to social and economic success? Not everyone will go to college, nor will they want to. Earning a sustainable living is still possible via internships, apprenticeships, and attending trade schools.

However, when the possibility of earning more money, developing a career, and moving up into a higher socio-economic class is discussed, most people rightly consider colleges and universities the best indicators of social mobility and economic success.